As you know, we strongly believe owning, and carefully buying income producing real estate (without overpaying) beats the volatile stock market. While others panic in the wild market corrections we have seen over the last few months (due to Greece, Chinese stock market correction, Iran, interest rate cuts, ..) , we coolly collect rent month after month after month, slightly rising forever and ever, and pay down our mortgage month after month after month building equity slowly but steadily. Slowly and steady is how you build wealth, a little bit every month.

With ever increasing regulatory overhead and initial pretty high fund raising costs it makes sense to HOLD assets longer than in the past. Let me elaborate:

Raising money in a syndication, like PRISM A or Kings Castle LP (or any of our earlier LPs like LP3 or LP4) using the current Canadian security legislation for non-accredited investors is very expensive. We have to create an offering memorandum (OM) with audited books in IFRS formats to the tune of at least $40,000 per OM and $20,000 for an annual update. We need to market our product, which is about 3-5% of funds raised. Then we pay a commission to the now mandatory EMD, the exempt market dealer. Plus we then pay for asset acquisition related costs including necessary repairs and upgrades to an asset. This adds up, to cost-of-funds-raised of 13-17% which has to be made up on asset performance – and while certainly doable repeatedly – will take time.

==> As such, a five year hold is often far too short.

10 years is far better as our fundraising and marketing costs in any LP go to 0 after a while and our operating costs are very very tiny after a few years as well. Thus, selling an asset in year 5, 6 or even 7 is frequently too early ! If we re-finance an asset, such as we plan in our large Castleview asset in Calgary co-owned by two of our LPs, namely 75% by PRISM LP, and 25% by our latest Kings Castle LP, we pay maybe 1% to 1.25% to access $5M – far cheaper than raising new money which would cost us 8-12 fold that ! As such, return expectations in private equity – except higher risk development projects – in 4-6 years have to be moderated and a longer hold period is suggested.

Please take at least a ten year view in any rental income real estate venture, be it PrestProp’s or any other, especially in markets that do not rise 6-10% annually like we have seen the last 2 or 3, or in the run-up to 2007. Markets will rise, but not as fast in a slower growth world. To compensate for slow growth, we get super cheap mortgages – see our article on our blog recently why we believe they will stay low for 20+ years. Real estate is a proven path for wealth creation, if the asset is held long enough.

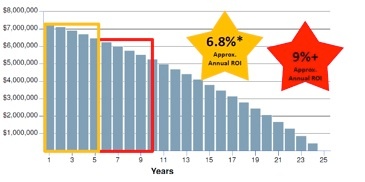

The chart below shows a typical mortgage amortized over 25 years. It shows that even in flattish market one can make money and why it is so hard to lose money in this asset class. The example assumes an asset for $10.5M with a $3M down payment i.e. a $7.5M mortgage – similar to an asset we bought in Edmonton for Kings Castle LP. In 5 years we pay down this mortgage by roughly $1.025M, which is about 34% of the invested cash of $3M, or 6.8% per year on average. In the years 6-10 we pay down a further $1.45M or so, or almost 45% or about 9% per year of the $3M. That is not counting any likely value upside, nor any cash-flow. Then in year five, or again in year ten, we can free up cash and:

a) send it to investors or

b) use your NAV to exit or

c) buy more assets.

Please consider these facts in light of your investment, your financial goals and your potential redemption decisions.

Don’t wait to invest in real estate – Invest in real estate and wait !

Thank you for your continued interest. Please contact an Exempt Market Dealer (EMD), Scotty or Denise for any questions that you may have !

Sincerely + Successful Investing,

Thomas Beyer President

Prestigious Properties Group

T: (403) 678-3330

www.prestprop.com